Reaching Out to Our Injured

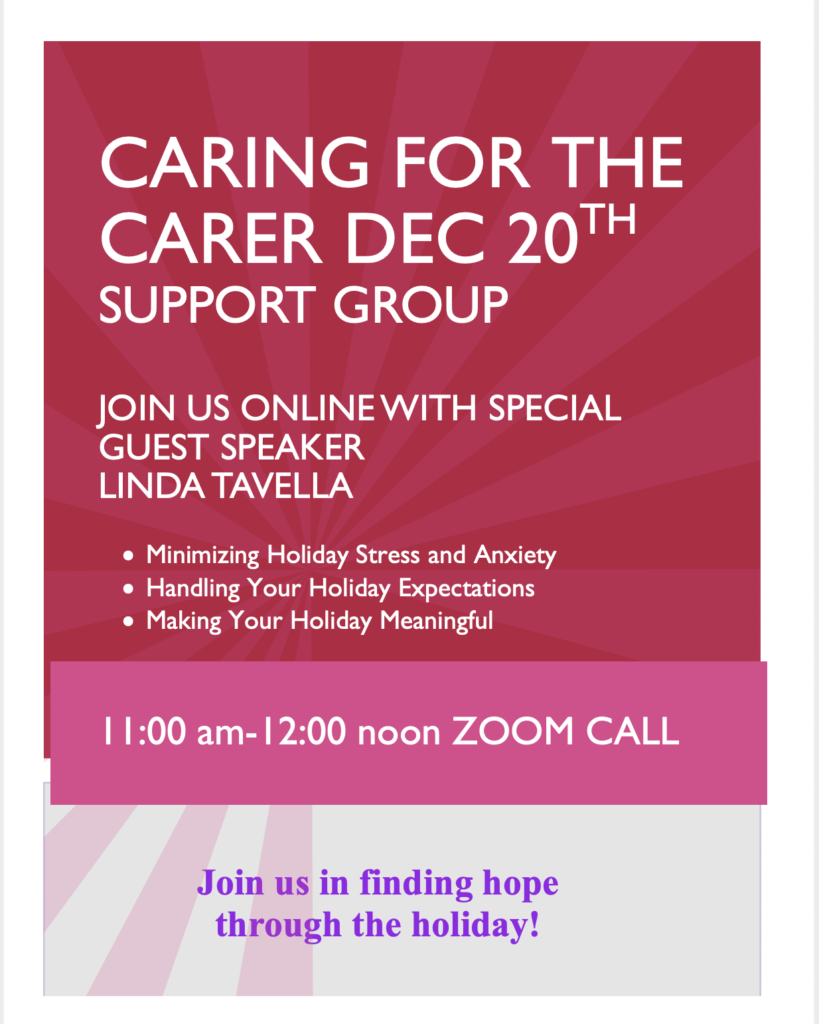

Join the Zoom call!

Free Audio Recording

There may come a time when I will need an exit plan. Within my Entrepreneurship Master’s Program I have been required to create that plan. The exit strategy known as liquidation can be described as the process by which a business closes and sells off business assets (Maguire, 2016). Assets of the business such as business property would be sold to obtain cash (Maguire, 2016). Additional items such as inventory on hand can also be sold off or liquefied (Rogers, 2014), as well as, fixtures, equipment, and furniture (McCarty, n.d.). The cash obtained would first be used to pay off any outstanding debts the business owes (Maguire, 2016). In certain circumstances and if a company has multiple stores, it may become necessary for a business to liquefy certain locations due to lack of sales in that area or due to outside issues unrelated to the company. In this case, the business may find they must close a location, liquefy assets, and relocate employees to other locations.

The exit strategy that I have chosen is liquidation. I have chosen liquidation because it will be the easiest way for me to obtain cash for the books that I currently have in inventory. Since my books are available on Amazon and cost me nothing to remain there, I can leave my books on Amazon and continue to obtain passive income while at the same time reclaim the monies that I have invested in my business. In addition, I am the only stakeholder.

References

Maguire, A. (2016, November 23). Cashing out: Understanding different exit strategies. Retrieved August 29, 2019, from https://quickbooks.intuit.com/r/business-planning/cashing-out-understanding-different-exit-strategies/

McCarty, D. (n.d.). Liquidation as an exit strategy. Retrieved August 30, 2019, from https://www.bizfilings.com/toolkit/research-topics/running-your-business/exit-strategies/liquidation-as-an-exit-strategy

Rogers, S. (2014). Entrepreneurial finance: Finance and business strategies for the serious entrepreneur. Place of publication not identified: McGraw Hill Education.

Cash flow is extremely important for businesses as cash flow allows for businesses to run smoothly. The lack of cash flow can spell disaster for businesses. Rogers (2014) noted, “Nothing is as important to a business as a positive cash flow.”

What is Cash Flow?

Cash flow can be defined as “…the net amount of cash and cash-equivalents being transferred into and out of a business” (Kenton, 2019). Specifically, businesses desire to have positive cash flow. negative cash flow will have negative effects on the business. Rogers (2015) noted the importance of business owners managing a business’ cash and Kenton (2019) noted that cash flow can be used to measure the overall health of a business. Rogers (2014) noted, “The goal of good cash management is obvious: to have enough cash on hand when you need it.” Cash flow must be sufficient enough to meet the needs of the business at all times (Rogers, 2014).

Cash Flow and Business Success

Positive cash flow helps ensure business success. Positive cash flow enables businesses to pay expenses and settle debts, pay shareholders, and reinvestment in the business (Kenton, 2019). Further, Kenton (2019) stated that positive cash flow allows for businesses to save in case of challenges in the future. Rogers (2014) noted uses of cash flow include loan payments which may or may not include both principal and interest, rent, insurance, and taxes. In addition, business owners can use positive cash flow to make further investments and in case of difficulties within the markets positive cash flow allows for businesses to stay afloat during financial downturns. (Kenton, 2019). These are a few positive effects of a business having positive cash flow which ensure that businesses can run smoothly and be successful.

Cash Flow and Negative Consequences

Rogers (2014) noted that negative cash flow means that a business is not able to purchase inventory, pay bills and utilities, or make payroll expenses. Negative cash flow may mean that the lights get turned off. Negative cash flow can push businesses into insolvency (Rogers, 2014). Potential downturns in the market could easily cause the loss of the business if there is no cash flow to count on during difficult times (Kenton, 2019). Investors potentially may lose all of their investment monies (Kenton, 2019), as well as, the entrepreneur especially if they have bootstrapped their business venture (Rogers, 2014). These are a few of the negative consequences when a business does not have the appropriate amount of cash flow.

To sum it up:

Cash flow is extremely important for businesses as cash flow allows for businesses to run smoothly and the lack of cash flow can spell disaster for businesses.

References

Kenton, W. (2019, August 28). Cash flow. Retrieved September 05, 2019, from https://www.investopedia.com/terms/c/cashflow.asp

Rogers, S. (2014). Entrepreneurial finance: Finance and business strategies for the serious entrepreneur. Place of publication not identified: McGraw Hill Education.

What is GoFundMe?

The following is an overview I compiled from the GoFundMe website for an educational assignment. While I have tried to be as accurate as possible, please see the website to obtain full details.

GoFundMe is a crowdfunding website that enables individuals, groups and organizations to raise money for different purposes. Fundraiser purposes listed on the GoFundMe website include: emergency, medical, memorial, charities, educational, nonprofit organizations, animals, business, community, creative, competition, events, faith, family, sports, travel, newlyweds, volunteers, wishes, and other. GoFundMe advertises that they are “the #1 expert” in online fundraising. They list trust, speed, tools, reach, and service as reasons for their success. See website for full and accurate details.

Description of the Requirements Needed

to Qualify as a Potential Candidate:

There appears to be no requirements needed to qualify. Anyone can start a fundraising campaign. GoFundMe advertises they have no eligibility requirements. See website for full and accurate details.

Steps in the Process:

(Chart created from information located on the GoFundMe website by Patricia Kay Reyna, please see website for full details.)

| Steps 1-3 | Steps 4-6 | Steps 7-9 | Final Steps |

| 1- Sign up on Site and Determine Fundraising Goal | 4-Send out Emails to your contacts | 7- Receive Donations | Apply Funds to Goal |

| 2-Prepare Your Story | 5- Send out Text Messages to Your Contacts | 8- Thank Donation Donors | |

| 3- Select Pictures or Videos to Use | 6- Share Your Fundraiser on Social Media | 9- Funds are Withdrawn |

Success of the GoFundMe:

The current top three fundraisers as of today, 8-30-2019. See the website for full details.

“Contribute to Yash’s Future” Carteret, NJ (Raised $277,822 of $200,000).

“Help for baby Atlas” Fairbanks, AK (Raised $155,275 of $100,000).

“Help 6 Year Old Guy Sizikov” Sunnyvale, CA (Raised $128,427 of $180,000).

What GoFundMe takes as a Fee:

GoFundMe advertises as a free fundraising platform with no sign-up fees or eligibility requirements. Tips that are given by donors maintain the GoFundMe platform. There is a processing fee of 2.9% + $.30 per transaction). See website for full and accurate details.

How Long Does it take to get the Money Raised?

GoFundMe advertises that there is no long waiting period to get the money raised and that funds can be withdrawn “right away.” Withdrawing money does not affect the campaign. See website for full and accurate details

Restrictions:

There appear to be no restrictions.

Reporting Requirements:

There appears to be no reporting requirements. However, there is a way for people to submit claims if they feel funds are misused or if law enforcement determines funds were misused. Donations are refunded if determined that something “isn’t right” according to the website. These statements are backed by The GoFundMe Guarantee. See website for full and accurate details.

References

All of the information provided regarding GoFundMe was obtained from the GoFundMe website found at the following link:

The exit strategy known as liquidation can be described as the process by which a business closes and sells off business assets (Maguire, 2016). Assets of the business such as business property would be sold to obtain cash (Maguire, 2016). Additional items such as inventory on hand can also be sold off or liquefied (Rogers, 2014), as well as, fixtures, equipment, and furniture (McCarty, n.d.). The cash obtained would first be used to pay off any outstanding debts the business owes (Maguire, 2016). In certain circumstances and if a company has multiple stores, it may become necessary for a business to liquefy certain locations due to lack of sales in that area or due to outside issues unrelated to the company. In this case, the business may find they must close a location, liquefy assets, and relocate employees to other locations.

There are pros and cons to the liquidation exit strategy business owners should keep in mind. On a positive note, the liquidation exit strategy can keep a business from acquiring additional debt and going further into a financial hole (Maguire, 2016). An additional positive of the liquidation exit strategy is that professional firms can be hired to help make the process as successful as possible (McCarty, n.d.). Finally, McCarty (n.d.) noted that the liquidation exit strategy can be a rewarding process for business owners when all goes well making this strategy worth considering. However, one con that Maguire (2016) noted was that business owners and investors may not be able to obtain their financing back if a business uses the liquidation exit strategy and does not have large enough assets and property to liquefy to repay debts owed. McCarty (n.d.) noted that retail inventory liquidation can be challenging and markdowns of merchandise must be determined. These are just a few pros and cons of using liquidation as an exit strategy.

References

Exit strategies – Examples, list of strategies to exit an investment. (2019). Retrieved August 29, 2019, from https://corporatefinanceinstitute.com/resources/knowledge/strategy/exit-strategies-plans/

Maguire, A. (2016, November 23). Cashing out: Understanding different exit strategies. Retrieved August 29, 2019, from https://quickbooks.intuit.com/r/business-planning/cashing-out-understanding-different-exit-strategies/

McCarty, D. (n.d.). Liquidation as an exit strategy. Retrieved August 30, 2019, from https://www.bizfilings.com/toolkit/research-topics/running-your-business/exit-strategies/liquidation-as-an-exit-strategy

Ohnesorge, L. (2019, June 12). Dillard’s leaves Cary Towne Center. Retrieved August 29, 2019, from https://www.bizjournals.com/triangle/news/2019/07/12/dillards-leaves-cary-towne-center.html

Rogers, S. (2014). Entrepreneurial finance: Finance and business strategies for the serious entrepreneur. Place of publication not identified: McGraw Hill Education.

A Source of Funding For Small Business…

Financing a new entrepreneur venture is imperative for the success of the venture. New entrepreneurs often wonder where to begin. Saberwal, author of the article “Supporting Start-ups” (2017), mentioned certain entrepreneurs as being “…a different breed: highly educated, assessing large amounts of money from diverse sources, growing their teams and dreaming of creating high-end products or services (p. 195).” This description sounds both exciting and motivating. Yet, new entrepreneurs must decide on where to begin in the process of accessing small or large amounts of available funds. Zarenzankova-Posevska, author of the article “Most Favorable Financial Instruments for Entrepreneurship Development” (2017), noted that without funding, new business ideas cannot grow or prosper. One of the most important parts of a new business is, without a doubt, funding. Grants are one source of funding that new entrepreneurs should consider. Grant funding is available (without requiring repayment) when businesses meet certain criteria for individual grants.

Types of Grant Funding:

Federal grant eligibility for small businesses, depends on the size of the small business. This size determination is made by the U.S. Small Business Administration. Grants.gov is the perfect place to start. This website contains a plethora of information regarding the grant process including basic information about grants, who is eligible to apply, and allows users to search a grant database. Users can filter available grants and apply for those of interest.

These entities include for-profit businesses and nonprofit organizations that provide funding assistance. Several links are available for non-federal entity grants at grants.gov.

Applying for Grants:

Once grants are located, small businesses should consider how best to apply. Hiring an experienced grant writer could be an important choice. Experienced grant writers have the skills to create a successful grant application. Grants are highly sought after; therefore, the overall quality of the grant application is extremely important to beat out the competition. Roszkowska and Konopka (2016) recommend keeping in mind several factors when applying for grants that those giving the grant may consider. These factors include the professional experience of the business founder, evaluation of the start-up’s business plan, and credit history of the applicant (Roszkowska & Konopka, 2016). Making sure to meet all grant requirements is also important. Attention to detail is key.

Where to start looking for grant funding:

Check out the Grants 101 page at the following link: https://www.grants.gov/web/grants/learn-grants/grants-101.html

Educate yourself on eligibility requirements at the following link:

https://www.grants.gov/web/grants/learn-grants/grant-eligibility.html

Determine if your small business size qualifies at the following link: https://www.sba.gov/document/support–table-size-standards

Best of luck Grant hunting!

References

(n.d.). Retrieved August 30, 2019, from https://www.sba.gov/funding-programs

Find. Apply. Succeed. (n.d.). Retrieved August 30, 2019, from https://www.grants.gov/web/grants/learn-grants/grants-101.html

Roszkowska, E., & Konopka, P. (2016). Application of the Mars Method to the Evaluation of Grant Applications and Non-Returnable Instruments of Start-Up Business Financing. International Workshop on Multiple Criteria Decision Making, 11, 153–167. https://doi-org.lopes.idm.oclc.org/10.22367/mcdm.2016.11.10

Saberwal, G. (2017). Supporting start-ups. Current Science (00113891), 113(2), 195–196. Retrieved from https://lopes.idm.oclc.org/login?url=http://search.ebscohost.com/ login.aspx?direct=true&db=a9h&AN=124280375&site=eds-live&scope=site

Zarezankova-Potevska, M. (2017). Most Favorable Financial Instruments for entrepreneurship development. Vizione, (28), 337. Retrieved from https://lopes.idm.oclc.org/login?url=http://search.ebscohost.com/ login.aspx?direct=true&db=edb&AN=125123582&site=eds-live&scope=site

Listen to my podcast of a ministry event, where I was one of the speakers, for encouragement to press through difficult situations that you did not want and that you have yet to get rid of: